Heat Treated Steel Bar And Tube

HEAT TREATED STEEL BAR AND TUBE

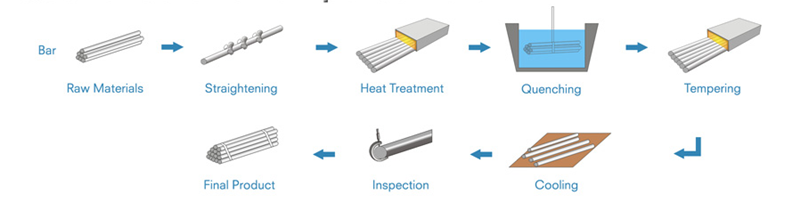

Heat treated steel bar is produced by heating and cooling in different temperature based on the steel grades to improve the steel bar mechanical properties or machinability for various industrial applications. Heat treated steel bar includes annealed steel bars, Normalized Steel Bar, quenched and temper qt steel bar.

Annealed Steel Bar has better ductility and lower hardness, which can be easier to be machined. The annealing processing is usually widely used for steel grade with higher carbon content above 0.5%. However, some low carbon steel also requires to do annealing for special usage such as 20CrMnTi gear steel. For some special material such as 20CrMnTi gear steel and GCr15 such bearing steel, spheroidizing annealing is often required.

Normalized steel bar sometime is also one kind of annealing processing. It mainly changes the grain to remove the impurities in steel and improves the strength and hardness. For some hot rolled steel bars, to keep the basic mechanical properties, normalizing is often used.

Quenching and Tempering, abbreviated as Q&T is a king of processing that strengthen or harden steel bars by heating the materials and then cooling in water, oil or other liquid medium, that rapidly the change from austenite to perlite to get the proper properties for various usage. The quenched & tempered steel bar materials are usually with carbon from 0.30% - 0.60%, it is widely used as merchant bars in components of various machines.

Our advantages on producing heat treated steel bars:

1) Big stocks of hot rolled round bars or wire rods as raw materials

2) Wide range of Cold Drawn Steel Bar sizes: from 10mm to 150mm

3) Different cold drawing medias powder or oil to get different surface

4) Straightening machines to get better straightness up to 0.5mm/m

5) Grinding and polishing machines to get better roughness upto 0.4um

6) Heat treating furnaces to adjust the mechanical properties

7) Full sets of testing equipment to test the sizes, mechanical properties and microstructure.

8) Multiple packages to avoid broken packages and anti-rusty

4140 steel tube,Round Steel Tubing,Heat Treated Steel Tube,Heat Treated Steel Bar And Tube,S355JR steel tube SHANDONG LE REN SPECIAL STEEL CO., LTD. , https://www.sdcolddrawnsteelbar.com

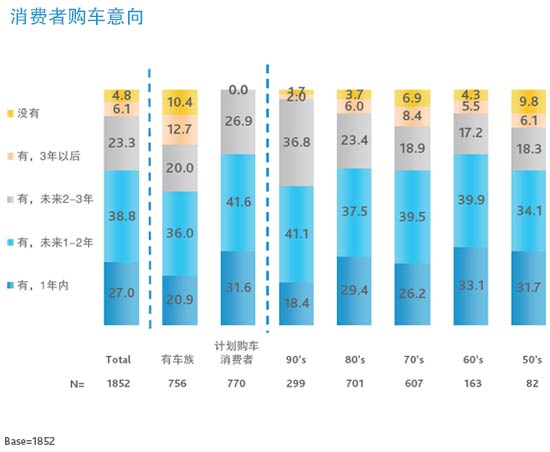

In this study, Nielsen found that there are several important differences in the purchase intentions and concerns of potential car buyers of different age groups. For example, in the short-term purchase intentions, consumers constitute the main force after 60: 74% of people said they plan to buy cars in the next one to two years. Nearly two-thirds (66%) of consumers in the post-50s, 70s, and 80s have similar plans. Of consumers born in the 1990s, this figure is 60%.

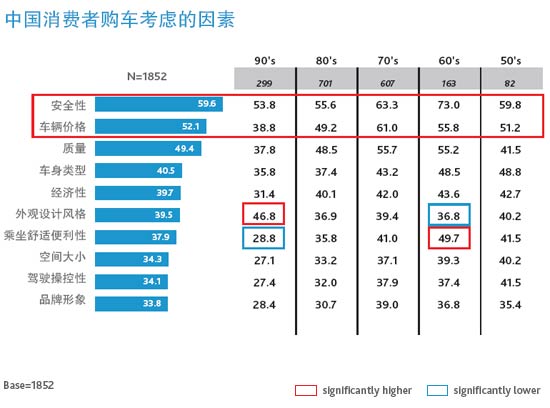

The top priority for consumers when buying a car

Overall, 60% of consumers said that when considering car purchases, safety is the first factor to consider. The price is the second most important factor (52%), again the quality (49%). However, the considerations of consumers in different age groups are different:

Consumers born in the 1950s: These consumers are mature consumers and the three most important factors they care about are safety (60%), price (51%) and style (49%). Economy ranks only fourth. When buying a car, they almost always consider everything. Comfort, ease of driving, quality, size and design all affect their final decision.

Consumers born in the 1960s: These consumers are often more concerned with the quality of cars and are looking for "cost-effective" types of cars. The factor they care most about is safety (73%), followed by price (56%) and quality (55%). They are more concerned about comfort (50%) than other age groups.

Consumers born in the 1970s: Consumers in this age group are most sensitive to prices (61%), followed by safety (63%) and quality (56%). Compared to other age groups, they pay more attention to the brand image (39%).

Consumers born in the 1980s: Compared with other age groups, the focus of these future car buyers seems to be average, and there is no particularly outstanding demand. Their top priorities are safety (56%), price (49%), and quality (49%).

Consumers born in the 1990s: They are the new generation of Chinese consumers. When considering car purchases, their concerns are quite different from those of other age groups. They value design more than other age groups (49%), second only to safety (54%). Although prices (39%) are also one of the three major factors that they consider, there is clearly no other age group that value it. The focus on comfort and convenience (29%) is also relatively minimal.

Does rising oil prices indicate that alternative energy vehicles will be popular?

Rising gasoline prices provide opportunities for alternative energy vehicles such as hybrid and electric vehicles (EVs). In fact, 27% of consumers said that because of the increase in gasoline prices, they turned their attention to new energy vehicles. Consumers' familiarity with oil/electric hybrid vehicles is still very high (44.6%). Because there are a relatively large number of hybrid vehicles on the road today, relatively few consumers are familiar with electric vehicles (38.4%). One of the factors that restricts the development of electric vehicles is that it is far more expensive than hybrids and standard cars. This is why only 48% of consumers have a purchase intention for electric cars, while 67.9% of consumers are interested in buying an electric/electric hybrid car.

At this year's Shanghai Auto Show, many of the electric car models on display left a deep impression on the consumers under investigation. In particular, smart and Volt attracted people's attention with its outstanding design and electric vehicle technology.

Looking to the future: How do automakers deal with these differences?

Consumers of different eras have different needs and concerns, and automakers must understand these differences in order to catch up with the expected growth in the coming years. Although only 18% of consumers born in the 1990s plan to buy cars next year, they already have a clear idea of ​​what kind of car they want. Now auto companies should seize this opportunity to start communicating with this generation, listen to their opinions, better determine their needs, and understand their motivation for buying cars. The lead actor will have the opportunity to lead other companies.

As fuel prices continue to rise, potential buyers also accept alternative energy vehicles. Pure electric car manufacturers should make efforts to make consumers familiar with the advantages of their products. Given the expected growth in the automotive market, investment in this area is likely to have a significant effect.

Nielsen: China Automotive Consumer Market Insights Report

China's auto market is developing rapidly: In the past five years, China is the only country that has maintained an annual growth rate of more than 20%. In 2010, its growth rate even reached 30 percent! Although the prices of daily necessities and fuels continue to rise, the desire of Chinese people to own cars is as strong as ever. According to Nielsen's latest survey, nearly 94% of Chinese consumers said they plan to buy cars in the short or long term. More than a quarter (27%) said they planned to buy a car within a year, and 39% said they would buy a car in the next one to two years.