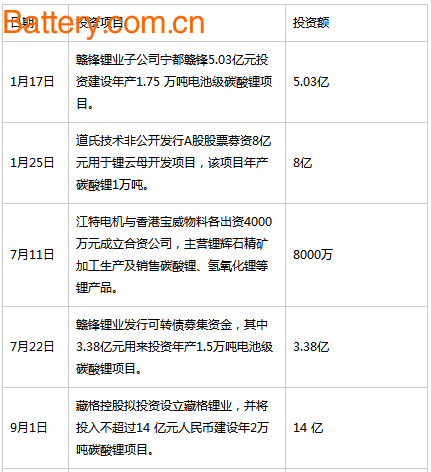

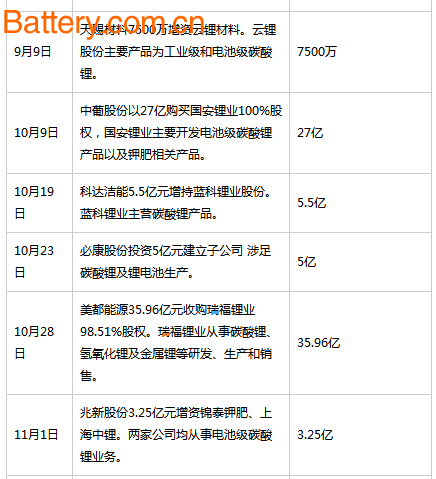

Lithium carbonate was "mad" this year, and it was very hot. It is estimated that the power battery accounts for 30%-40% of the new energy vehicle manufacturing cost, and the cathode material accounts for more than 40% of the total cost of the power battery. Lithium carbonate is also a key raw material for the preparation of cathode materials. Lithium carbonate has naturally become the most attractive sector in the upstream industries of new energy vehicles and power batteries. From BYD to Salt Lake, from Yanfeng Lithium to Tianqi Lithium, from Dow Technology to Zongge Holdings... According to today’s battery magazine-China Battery Alliance, incomplete statistics, in the past year, 22 investments were implemented. On the head of lithium carbonate, the total investment amount is as high as 22.7 billion yuan. Prices are skyrocketing, and investment is coming Starting this year, under the pull of new energy vehicles and power battery industry, the price of lithium carbonate has shown an upward trend. According to relevant data, the price of lithium carbonate rose slowly in the first half of the year. From July to August, the price of lithium carbonate increased significantly. The price of industrial grade lithium carbonate ranged from 120,000 yuan/ton to 159,000 yuan/ton. It is 33%; the price of battery-grade lithium carbonate is from 130,000 yuan/ton to 170,000 yuan/ton, an increase of 35%. As of December 25, 2017, the average price of industrial grade lithium carbonate was 176,333 yuan / ton, the highest price of battery-grade lithium carbonate was 159,000 yuan / ton, and the price of lithium carbonate reached a record high. The price of lithium carbonate has risen all the way, attracting a large number of listed companies such as Tianqi Lithium Industry, Yanfeng Lithium Industry and Tianci Materials to build or expand production capacity. Especially since the second half of this year, the investment momentum of lithium carbonate can be described as crazy. According to statistics, the total investment in lithium carbonate reached 22.7 billion this year. List of listed companies' lithium carbonate investment projects in 2017 Rich profits, cross-border people have joined The price of lithium carbonate has skyrocketed, and its profits are also very impressive. Industry insiders have said that the gross profit margin of lithium carbonate this year may reach 60%-70%. According to the relevant data, the price of lithium carbonate benefited, and the gross profit margin of domestic “Lithium Industryâ€, Lifeng Lithium and Tianqi Lithium Industry in the first three quarters of this year reached 37.59% and 69.77% respectively. Jiangte Motor also said in September this year that its subsidiary Yichun Silver Lithium New Energy has been officially put into operation, producing 10 tons of lithium carbonate per day, with a gross profit of nearly 100,000 yuan per ton. Rich profits have made lithium carbonate a scent of the capital market. Some laymen are also eager to move, and cross-border intentions to share a piece of pie, such as China and Portugal shares, Zhaoxin shares, Bikang shares, Yongxing special steel. Sino-Portuguese is a wine company that integrates grape growing, production and sales. It specializes in wines from the Western Region, Niya, Xintian and other brands. Due to the sluggish domestic wine industry, China and Portugal will focus on the lucrative lithium carbonate industry. In October this year, Sino-Portuguese shares announced that they would acquire a 100% stake in Guoan Lithium Industry for 2.78 billion yuan and lay the foundation for the company's strategic transformation of the new energy industry with the lithium carbonate industry of Guoan Lithium. Zhaoxin Co., formerly known as “Shenzhen Rainbow Fine Chemical Co., Ltd.â€, is one of the largest aerosol manufacturing companies in China's fine chemical industry. Its core products are environmentally friendly functional coatings and accessories, green and environmentally friendly household products, and environmentally friendly and energy-saving automotive beauty. Care products, etc. In August this year, trillion new shares declared intention to acquire lithium battery accessories company shares and Lee Ah lithium battery separator business-strong new material, and to get into the lithium battery industry. However, the acquisition of ALi shares failed, and the unwilling Zhaoxin shares will target lithium carbonate, and will invest 325 million yuan to increase Jintai Potash and Shanghai Zhongli. Immediately after the acquisition of Huiqiang New Materials, it failed, so it simply smashed 400 million yuan for Jintai Potash. Later, it invested 50 million yuan to establish a joint venture company with Yanfeng Lithium to build a 7,000-ton lithium carbonate production line. Lithium carbonate has become the only investment direction of Zhaoxin in the lithium battery industry chain. The investment risk is also frustrated. Of course, among the lithium carbonate investors, not all of them are proud of the spring breeze, and there are many people who are frustrated. It is understood that lithium carbonate extraction is divided into two kinds of lithium extraction from salt lake and lithium extraction from ore, and 76% of the global lithium resources are distributed in the salt lake, which determines the important position of lithium extraction in the salt lake. However, due to the poor endowment of many salt lakes in China, the impurity content is high and the separation of magnesium and lithium is difficult. In addition, the versatility of the lithium extraction technology in the salt lake is poor. The application of ripening in a salt lake does not mean that it can be successfully applied to another salt lake. As a result, companies face a lot of risks when investing in lithium carbonate, and the resulting investment failures are numerous. In February 2015, Steyr was not satisfied with its main diesel engine business. It invested 153 million yuan to increase the capital of Hengxin Rong Li and obtained 51% of its equity, and entered the upstream industry of new energy vehicles. Transformation. Hanson is a research financing lithium battery lithium carbonate raw materials, production and marketing enterprises, located in neighboring Qinghai Lake. In the two years after Steyr acquired Hengxin Rong Li, its planned annual output of 18,000 tons of lithium carbonate project has not been able to mass production, and seriously dragged down the company's overall performance. Steyr said that the construction site of Qinghai Lithium Carbonate Project is located near the Jintai Lake in Xitai. It is geographically remote and away from the living industrial zone. It lacks public facilities and the production conditions are extremely bad, which has caused the project schedule to be postponed. The swampy Steyr finally decided to abandon the lithium carbonate business, sold a 51% stake in Hengxin Rong Li in April this year, and returned to its old business - the engine business. Western Mining announced in February 2016 that it will acquire a 100% stake in Qinghai Lithium. However, after more than a year of planning, Western Mining finally decided to abandon the acquisition of Qinghai Lithium in August this year. Western Mining said that due to the significant uncertainty in the timing of the acquisition of the mining warrants of Qinghai Dongtai Jiiner Lithium Resources Co., Ltd., the main business of Qinghai Lithium was to commission lithium carbonate products for the lithium resources company, which constituted the acquisition. Substantial obstacles to the matter, I decided to abandon the acquisition of Qinghai Lithium. In May of this year, Yinfeng Holdings plans to invest in the establishment of Xianfeng New Energy Technology Co., Ltd. through cooperation with the technical parties, and engage in the production and technical services of lithium-ion lithium ion enrichment materials in salt lake brines, and cut into the lithium carbonate industry. In line with the fact that the counterparty ultimately failed to reach an agreement on the core terms of the trading program (transaction price and trading conditions, etc.), Xianfeng Holdings announced the termination of the transaction in October this year. Of course, Xianfeng Holdings did not give up lithium carbonate, and announced in December that it would invest in a production project with an annual output of 30,000 tons of industrial grade lithium carbonate through cooperative investment. This is a follow-up. Good play, Taiwan, you sing, I will debut. At the same time of investment, the 2017 lithium carbonate industry has also had many intriguing stories, the most striking of which is the lithium carbonate dispute between Tianqi Lithium and Shanshan Energy. In June last year, Shanshan Energy brought the lithium carbonate product supplier Tianqi Lithium to court because of the supply schedule. Shanshan Energy said that Tianqi Lithium did not fulfill its contractual obligations as agreed and refused to deliver the goods in accordance with the contract, and applied for a warrant to compensate the losses and return the advance payment. In the hearings, two lithium Ikegami downstream enterprises also erupted in a fierce war of words. Shanshan Energy successively issued a document exposing the lithium carbonate products of Tianqi Lithium to have quality defects and random price increases, while Tianqi Lithium said that Shuangfa has been negotiating in business. The purpose of Shanshan Energy is to be lower than the market. Price is available. On July 14 this year, the Hunan Provincial Higher People's Court made a final judgment. The defendant Tianqi Lithium Co., Ltd. compensated Shanshan Energy for an economic loss of 5,116,415 yuan and returned 5 million prepayments and capital interest on Shanshan Energy. This year-long lithium carbonate dispute has finally come to an end. The story of Salt Lake shares is also worth mentioning. The net profit of Salt Lake has continued to decline sharply since 2015. Until the first half of this year, the net profit became negative, with a huge loss of 523 million yuan, setting a record for the first half-year loss in the 20 years since its listing. Surprisingly, since the second half of the year, Salt Lake shares have suddenly gained attention in the capital market. According to public data, the A-shares of Salt Lake have risen from 9.45 yuan in July this year to 19.66 yuan on September 21, which has more than doubled. This situation has not even sat down with Salt Lake shares. It has issued a noticeable announcement on production and operation, indicating that the company is also facing a large pressure on performance losses, and investors are required to invest rationally. Is the investor a fool? After careful study of the annual reports of Salt Lake's shares, although its main business is losing money in successive years, its operating performance of Lanke Lithium, a subsidiary of its lithium carbonate business, has continued to improve. In 2013, 2014 and 2015, the lithium carbonate project of Lanke Lithium Industry lost 130 million, 92 million and 33.45 million respectively, and by 2016 the net profit became 140 million yuan. . In the first half of 2017, Lanke Lithium continued to achieve profitability with a net profit of 88.523 million yuan. This is the real reason why the Salt Lake shares have lost despite the losses. The momentum of the lithium carbonate industry and its appeal to investors can be seen. These two incidents are just the tip of the iceberg of the 2017 lithium carbonate industry. Since the demand for lithium carbonate in 2017 has been in a state of rapid growth, its prices have risen all the time, investment has entered, and companies have expanded. In the process, none of the relevant companies in the company can be independent. Some are proud, some are sad; those who are raised are there, and those who are squeezed also have it. The industry in the flood of lithium carbonate is embarrassing. Outdoor Repair Supplies,Waterproof Repair Kit,Field Repair Kit,Outdoor Research Repair Kit KRONYO United Co., Ltd. , https://www.kronyotirerepairkit.com